INVESTOR RELATIONS CENTER

Mercedes-Benz Group AG

News Detail

Pressemitteilung vom 02.08.2016

|

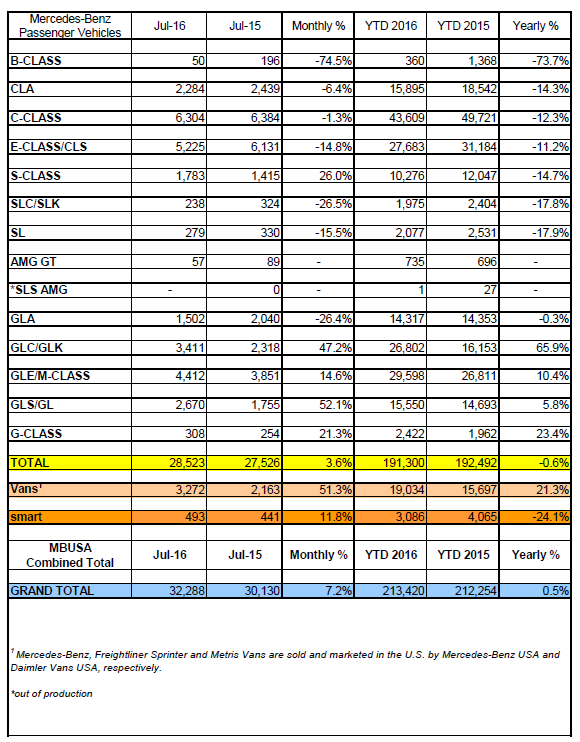

MERCEDES-BENZ USA JULY SALES HIT ALL-TIME HIGH OF 28,523 UNITS, UP 3.6% ATLANTA – Mercedes-Benz USA (MBUSA) today reported record July sales of 28,523 vehicles, increasing 3.6% from the 27,526 vehicles sold during the same month last year. Mercedes-Benz Vans also reported best-ever July sales with 3,272 units, and smart reported 493 units, up 11.8%, bringing MBUSA grand total to 32,288 vehicles for the month, up 7.2% from last year. “We are continuing to see strong momentum build into the third quarter, fueled by the recent launch of three of our dream cars,” said Dietmar Exler, president and CEO of MBUSA. “The S-Class Cabriolet, SL and SLC Roadsters, teamed with strong momentum for the all-new E-Class helped us set a new record for July.” Mercedes-Benz volume leaders in July included the C-Class, E-Class (including the CLS) and GLE model lines. The C-Class took the lead at 6,304, followed by the E-Class at 5,225. The GLE, rounded out the top three with 4,412 units sold. Mercedes-AMG high-performance models sold 1,565 units in July, up 68.1% from last year (931), with a total of 12,510 units sold year-to-date (up 79.3%). Separately, Mercedes-Benz Certified Pre-Owned (MBCPO) models recorded sales of 10,517 vehicles in July, an increase of 8.8% from last year (9,669). On a year-to-date basis, MBCPO sold 70,863 vehicles, an increase of 3.4%.

MERCEDES-BENZ USA Sales -- July 2016 This document contains forward-looking statements that reflect our current views about future events. The words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “may,” ”can,” “could,” “plan,” “project,” “should” and similar expressions are used to identify forward-looking statements. These statements are subject to many risks and uncertainties, including an adverse development of global economic conditions, in particular a decline of demand in our most important markets, caused for example by the possible exit of the United Kingdom from the European Union; a worsening of the sovereign-debt crisis in the euro zone; an increase in political tension in Eastern Europe; a deterioration of our refinancing possibilities on the credit and financial markets; events of force majeure including natural disasters, acts of terrorism, political unrest, armed conflicts, industrial accidents and their effects on our sales, purchasing, production or financial services activities; changes in currency exchange rates; a shift in consumer preferences towards smaller, lower-margin vehicles; a possible lack of acceptance of our products or services which limits our ability to achieve prices and adequately utilize our production capacities; price increases for fuel or raw materials; disruption of production due to shortages of materials, labor strikes or supplier insolvencies; a decline in resale prices of used vehicles; the effective implementation of cost-reduction and efficiency-optimization measures; the business outlook for companies in which we hold a significant equity interest; the successful implementation of strategic cooperations and joint ventures; changes in laws, regulations and government policies, particularly those relating to vehicle emissions, fuel economy and safety; the resolution of pending government investigations or of investigations authorizrequested by governments and the conclusion of pending or threatened future legal proceedings; and other risks and uncertainties, some of which we describe under the heading “Risk and Opportunity Report” in the current Annual Report. If any of these risks and uncertainties materializes or if the assumptions underlying any of our forward-looking statements prove to be incorrect, the actual results may be materially different from those we express or imply by such statements. We do not intend or assume any obligation to update these forward-looking statements since they are based solely on the circumstances at the date of publication.

If you have any questions, please contact our Investor Relations Team:

|

||||||||||